Offshore Trust Services Fundamentals Explained

Wiki Article

Getting My Offshore Trust Services To Work

Table of Contents5 Easy Facts About Offshore Trust Services ShownWhat Does Offshore Trust Services Do?Some Known Facts About Offshore Trust Services.Offshore Trust Services for BeginnersThe Definitive Guide to Offshore Trust ServicesRumored Buzz on Offshore Trust ServicesA Biased View of Offshore Trust ServicesIndicators on Offshore Trust Services You Need To Know

Exclusive financial institutions, also larger private firms, are more amendable to settle collections versus debtors with difficult and also reliable possession protection strategies. There is no property protection strategy that can discourage an extremely inspired lender with limitless money as well as perseverance, however a well-designed overseas depend on commonly provides the debtor a positive negotiation.Trustee business charge annual charges in the series of $1,000 to $5,000 per year plus hourly prices for additional solutions. Offshore counts on are not for everyone. For many people living in Florida, a residential property security strategy will be as efficient for a lot less money. For some individuals dealing with difficult financial institution problems, the offshore trust is the finest option to safeguard a considerable quantity of assets.

Debtors may have more success with an offshore trust fund strategy in state court than in an insolvency court. Judgment lenders in state court lawsuits might be frightened by overseas possession security counts on and might not look for collection of assets in the hands of an offshore trustee. State courts lack jurisdiction over offshore trustees, which means that state courts have restricted remedies to purchase conformity with court orders.

The Basic Principles Of Offshore Trust Services

borrower files insolvency. A bankruptcy borrower need to give up all their possessions and also lawful interests in residential property wherever held to the personal bankruptcy trustee. Insolvency courts have worldwide jurisdiction and are not discouraged by international nations' rejection to identify general civil court orders from the U.S. An U.S. bankruptcy judge might oblige the personal bankruptcy borrower to do whatever is required to commit the insolvency trustee all the debtor's properties throughout the globe, including the borrower's advantageous rate of interest in an offshore count on.Offshore property security depends on are much less efficient against Internal revenue service collection, criminal restitution judgments, and also household sustain obligations. The courts might try to urge a trustmaker to liquify a depend on or bring back trust properties.

The trustmaker should be eager to provide up lawful civil liberties and control over their depend on assets for an offshore trust fund to successfully protect these properties from U.S. judgments. 6. Option of a specialist and also dependable trustee who will certainly safeguard an overseas count on is more vital than choosing an offshore trust territory.

Excitement About Offshore Trust Services

Each of these nations has count on statutes that are positive for overseas possession security. There are subtle lawful distinctions amongst offshore trust jurisdictions' laws, but they have a lot more features in common.

Official stats on counts on are hard to come by as in many offshore jurisdictions (as well as in many onshore territories), depends on are not needed to be signed up, however, it is assumed that the most typical use of overseas trust funds is as component of the tax and economic preparation of affluent people as well as their households.

Getting The Offshore Trust Services To Work

In an Irreversible Offshore Trust may not be altered or liquidated by the settlor. An allows the trustee to pick the distribution of profits for different courses of recipients. In a Fixed trust, the distribution of earnings to the recipients is fixed and also can not be changed by trustee.Confidentiality and also privacy: In spite of the reality that an overseas trust is officially registered in the federal government, the events of the trust, possessions, as well as the problems of the count on are not taped in the register. Tax-exempt standing: Assets that are transferred to an overseas trust (in a tax-exempt overseas area) are not tired either when moved to the trust, or when transferred or rearranged to the recipients.

The 7-Second Trick For Offshore Trust Services

This has additionally been done in a number of United state states., after that the trustees must take a positive function in the events on the firm., yet stays component of trust law in lots of usual law territories.Paradoxically, these specialised types of trusts appear to occasionally be utilized in relationship to their initial intended uses. STAR trusts appear to be made use of more regularly by hedge funds forming mutual funds as system trusts (where the fund supervisors want to eliminate any type of obligation to go to meetings of the firms in whose protections they spend) and VISTA counts on are regularly used as a part of orphan frameworks in bond concerns where the trustees desire to separation themselves from overseeing the providing vehicle.

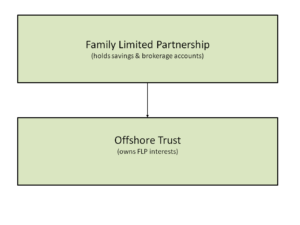

Certain jurisdictions (notably the Chef Islands, yet the Bahamas Has a types of property protection trust fund) have supplied special trusts which are styled as possession security trusts. While all trusts have an property defense element, some jurisdictions have enacted regulations attempting to make life tough for financial institutions to press insurance claims versus the trust (for instance, by attending to specifically brief limitation periods). An offshore depend on is a device made use of for possession protection and estate planning that functions by moving properties right into the control of a lawful entity based in one more country. Offshore depends on are unalterable, so count on owners can not recover ownership of transferred assets. They are likewise complicated and also expensive. Nonetheless, for individuals with higher obligation worries, offshore depends on can offer protection and also greater personal privacy in addition to some tax benefits.

Indicators on Offshore Trust Services You Need To Know

Being offshore includes a layer of security as well as personal privacy along with the capacity to take care of taxes. For circumstances, because the depends on are not located in the United States, they do not need to follow U.S. legislations or the judgments of united state courts. This makes it harder for financial institutions and litigants to go after cases against assets held in offshore trust funds.It can be challenging for 3rd celebrations to determine the possessions as well as proprietors of overseas trusts, which makes them help to personal privacy. In order to establish an overseas trust fund, the primary step is to select a foreign country in which to locate the depends on. Some popular places consist of Belize, the Cook Islands, Nevis and Luxembourg.

Getting My Offshore Trust Services To Work

Transfer the possessions that are to be protected right into the count on - offshore trust services. Offshore depends on can be useful for estate planning and possession security yet they have restrictions.people that establish offshore counts on can not get away all tax obligations. Revenues by properties positioned in an overseas trust fund are totally free of united state tax obligations. Yet united state residents who receive circulations as recipients do need to pay united state earnings taxes on the distributions. United state proprietors of overseas depends on likewise have to submit reports with the Internal Revenue Solution.

Offshore Trust Services Things To Know Before You Buy

Corruption can be a concern in some nations. In enhancement, it is essential to select a nation that is not likely to experience political unrest, regimen change, economic upheaval or fast adjustments to tax policies that might make an offshore trust less helpful. Asset security a knockout post trusts normally have to be developed prior to they are needed.They additionally don't flawlessly shield versus all insurance claims and may expose owners to risks of corruption and also political instability in the host nations. Offshore trust funds are helpful estate preparation as well as asset security devices. Understanding the right time to make use of a certain trust, as well as which trust fund would supply one of the most profit, can be confusing.

An Offshore Trust fund is a customary Trust fund shaped under the laws of nil (or low) tax obligation Global Offshore Financial Facility. A Count on is a lawful game plan (comparable to an arrangement) wherein one person (called the "Trustee") in accordance with a succeeding individual (called the "Settlor") grant acknowledge and hold the residential property to aid different individuals (called the "Beneficiaries").

Report this wiki page